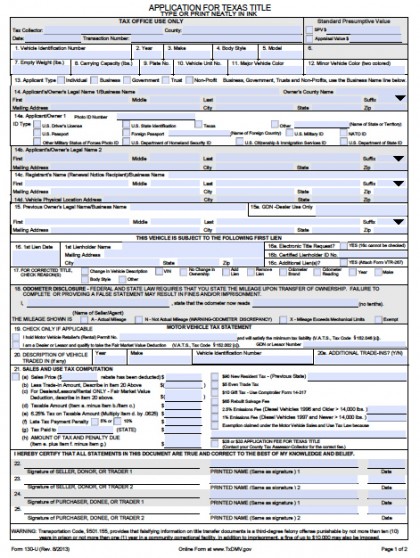

Texas Form 130-U | PDF Template

Sponsored Links

The Texas Form 130-U must be used to obtain the title to a car to become its legal owner using . Otherwise, the previous title holder could be legally responsible for obligations related to the car such as liens or parking violations.

Sponsored Links

In Texas, you need to use Form 130-U to apply for a car title, and you have to use this application in a number of instances when you need to transfer the title, including when you:

- Sell or buy a vehicle

- Remove a lien

- Transfer title a family member

- Gift a vehicle

- Inherit a vehicle

Most instances of title transfer occur when a car is sold or transferred to a family member. There are a number of steps to follow to transfer title when buying or selling a car. Sellers must:

- Record the odometer reading on the title.

- Sign and date the back of the title and record the sale price before giving it to the buyer.

- Transfer Form 130-U and the registration receipt to the buyer (the buyer must submit this application to the local tax office).

- Keep records of the transaction using a bill of sale that records each party’s personal contact information, the date of sale, price of the car, and car identification information.

- Submit a vehicle transfer notification to the local DMV.

Completing Form 130-U

The Application for Texas Title form has many items for you to fill out, some of which may be unclear. Here are short explanations to clarify some of the information the form requests:

- You can find the VIN on your title or on the inside of the driver’s door.

- Car weight and carrying capacity can be found quickly from online searches.

- The “minor vehicle color” is the color that is less prevalent on the car’s body, if there are two colors.

- The first lien date is the date a security agreement was signed to help finance the vehicle.

- Odometer readings may not be required if the vehicle is brand new, more than 10-years-old, weighs more than 16,000 pounds, or is being sold directly to a government agency.

- Rebates in the tax computation section are applicable only to retail purchasers.

- If subject to the diesel emissions fee, calculate this amount based on the taxable amount figure in 21(d).

- If the vehicle is being donated or gifted, both the giver and recipient must complete and sign Form 14-317, the Affidavit of Motor Vehicle Gift Transfer, which must be filed with Form 130-U.

Along with Form 130-U, the new car owner must file the registration receipt, proof of insurance, and the actual title in the county where the sale occurred or the applicant’s county of residence within 30 days of the sale.

Sources

Sponsored Links