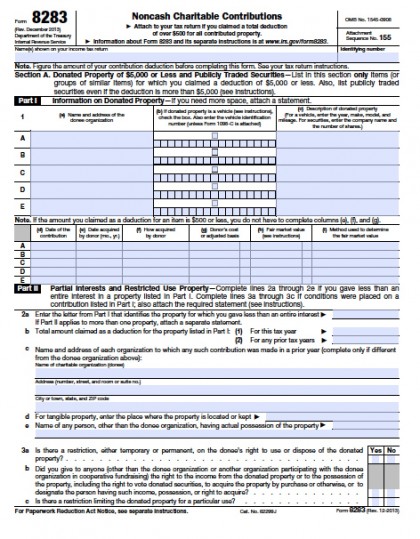

IRS Form 8283 | Noncash Charitable Contributions

Sponsored Links

Form 8283 is to be filed by corporations, individuals or partnerships only if they have made non-cash charitable contributions exceeding $500.

Sponsored Links

How to Complete

Step 1 – Complete Form – Print Form 8283 and complete all of the required information.

Step 2 – File – Once you have completed your form check to be certain that all of your information is correct to ensure proper deductions. Include this form with the rest of your tax return information.

Always check to be certain all information is correct and required documentation is provided to avoid denial of deductions or delays in processing your requests.

IRS Form 8283

Sponsored Links